Not known Incorrect Statements About Hsmb Advisory Llc

Not known Incorrect Statements About Hsmb Advisory Llc

Blog Article

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

Table of ContentsNot known Factual Statements About Hsmb Advisory Llc An Unbiased View of Hsmb Advisory LlcExamine This Report on Hsmb Advisory LlcThe 8-Second Trick For Hsmb Advisory Llc

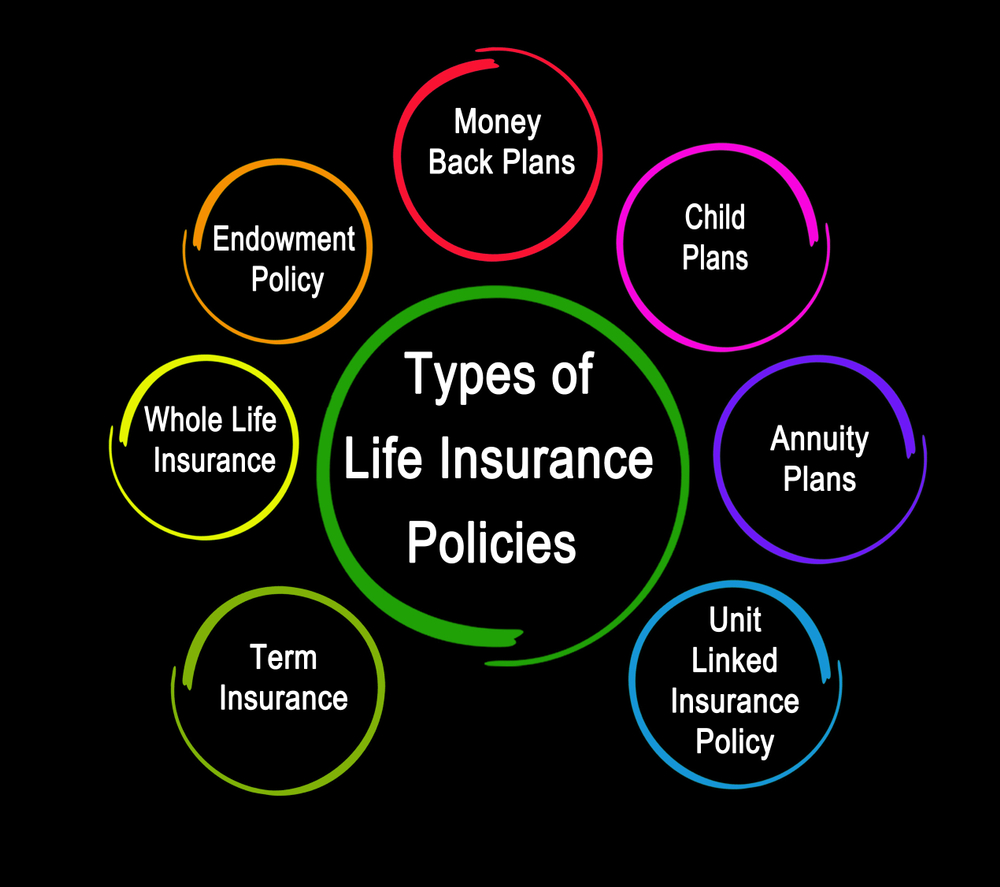

Life insurance coverage is especially important if your family hinges on your income. Sector professionals recommend a plan that pays 10 times your yearly revenue. When approximating the quantity of life insurance coverage you need, consider funeral service costs. Determine your family's everyday living expenses. These may include home mortgage payments, superior loans, bank card financial obligation, tax obligations, kid care, and future college expenses.Bureau of Labor Data, both partners worked and brought in income in 48. They would be most likely to experience financial hardship as a result of one of their wage earners' deaths., or personal insurance policy you buy for yourself and your household by speaking to wellness insurance policy companies straight or going with a wellness insurance agent.

2% of the American populace lacked insurance policy coverage in 2021, the Centers for Illness Control (CDC) reported in its National Center for Wellness Stats. Greater than 60% got their coverage with an employer or in the exclusive insurance coverage industry while the rest were covered by government-subsidized programs including Medicare and Medicaid, veterans' benefits programs, and the federal industry developed under the Affordable Treatment Act.

The Best Strategy To Use For Hsmb Advisory Llc

If your earnings is reduced, you might be one of the 80 million Americans that are eligible for Medicaid.

According to the Social Safety and security Administration, one in 4 employees getting in the labor force will become disabled prior to they get to the age of retirement. While wellness insurance pays for a hospital stay and medical bills, you are usually burdened with all of the costs that your paycheck had covered.

This would certainly be the very best option for securing budget-friendly special needs protection. If your company doesn't supply long-lasting insurance coverage, here are some things to take into consideration prior to acquiring insurance on your own: A policy that ensures income substitute is ideal. Several plans pay 40% to 70% of your income. The expense of impairment insurance policy is based on numerous variables, consisting of age, way of life, and health.

Many plans call for a three-month waiting duration before the insurance coverage kicks in, offer a maximum of three years' well worth of insurance coverage, and have significant policy exemptions. Below are your alternatives when acquiring automobile insurance: Responsibility coverage: Pays for building damages and injuries you cause to others if you're at fault for a mishap and likewise covers litigation prices and judgments or settlements if you're sued due to the fact that of a car accident.

Comprehensive insurance policy covers theft and damage to your car due to floodings, hailstorm, fire, vandalism, dropping objects, and pet strikes. When you fund your auto or lease an auto, this sort of insurance policy is necessary. Uninsured/underinsured driver () coverage: If an uninsured or underinsured vehicle driver strikes your automobile, this protection spends for you and your traveler's clinical expenses and might likewise represent lost income or make up for pain and suffering.

Employer insurance coverage is typically the ideal option, yet if that is unavailable, get quotes from a number of companies as numerous offer price cuts if you purchase greater than one kind of insurance coverage. (https://hsmbadvisory.edublogs.org/2024/02/26/health-insurance-st-petersburg-fl-your-guide-to-comprehensive-coverage/)

Not known Incorrect Statements About Hsmb Advisory Llc

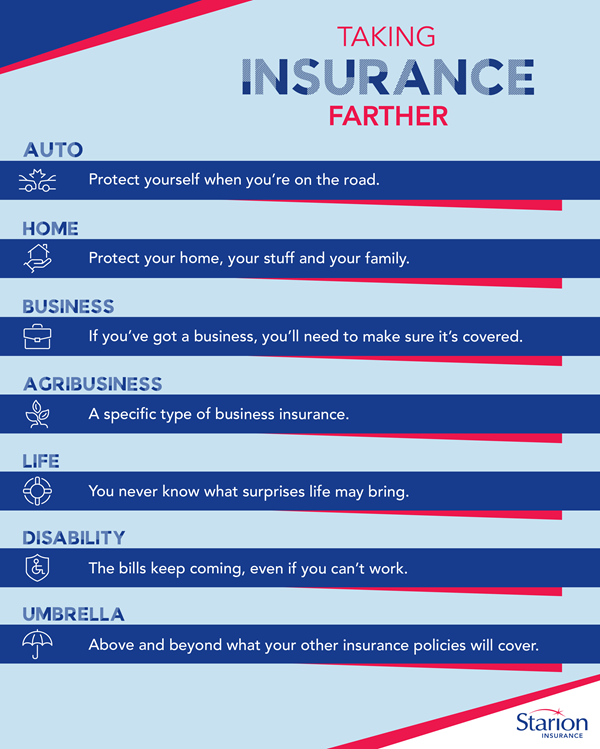

Between health insurance, life insurance policy, impairment, liability, long-lasting, and also laptop insurance coverage, the task of covering yourselfand assuming concerning the unlimited opportunities of what can happen in lifecan feel frustrating. But as soon as you recognize the fundamentals and see to it you're appropriately covered, insurance can improve economic self-confidence and well-being. Here are one of the most crucial kinds of insurance policy you need and what they do, plus a pair ideas to avoid overinsuring.

Different states have different guidelines, however you can expect wellness insurance (which lots of people make it through their employer), automobile insurance policy (if you Your Domain Name own or drive an automobile), and property owners insurance (if you have property) to be on the checklist (https://hsmbadvisory.edublogs.org/2024/02/26/health-insurance-st-petersburg-fl-your-guide-to-comprehensive-coverage/). Mandatory kinds of insurance coverage can change, so examine up on the most recent regulations every so often, specifically before you restore your policies

Report this page